- 1. Research and Develop a Trading Strategy

- 2. Mitigate Your Risk

- 3. Choose to Buy or Sell

- 4. Make a Practice Trade

Before moving to the first step below, be sure you know:

- Which commodities do you want to trade? Read our overview of the commodities market in general on our home page

- Which trading instruments do you want? You can choose from physical delivery, CFDs, shares, ETFs, futures, or options.

- Do background research. Successful commodity traders use the information found in scholarly articles, government websites, trade publications, the Farmers’ Almanac, charting software, and other sources.

How to Interpret Commodities Pricing

There are two types of commodity prices you’ll need to understand before you begin: spot prices and futures prices.

- Spot prices: The price at which a commodity is selling right now.

- Futures prices: The price for which a commodity contract agrees to sell for on a future date.

These prices can be vastly different from each other and can result in the following situations:

- Contango occurs when a futures contract is priced higher than the current spot price.

- Backwardation is the opposite of contango, when a futures contract price trades below the spot price.

How To Trade Commodities

Here’s a preview of the steps you’ll take to learn how to trade commodities.

- Research and develop a strategy.

- Mitigate your risk.

- Choose to buy or sell.

- Make a practice trade or a single test trade.

Now let’s go into more detail on each step.

1. Research and Develop a Trading Strategy

There are many commodity trading strategies. Most strategies combine two types of research: fundamental analysis and technical analysis.

Fundamental Analysis

This type of research involves studying the This type of research involves studying the economic factors that determine the value of an asset.

Fundamental analysis requires a trader to develop a keen eye for the supply and demand picture for a particular commodity.

Supply and demand are opposing forces. Rising demand positively impacts prices; rising supply negatively impacts prices, all other things being equal.

These research pieces on US Agricultural Wages and US States Most Dependent on Agriculture are a good example of data types you may want to find for fundamental analysis.

Production Level Patterns

Traders often look for broad trends in the output of individual commodities.

Patterns in the level of crops being produced, metals being mined, and crude oil being drilled can offer clues about the direction of markets.

- Inventories: As with output, inventory levels can be a great fundamental trading tool. Persistent drawdowns in inventories often accompany higher prices, while inventory buildups usually lead to price declines.

- Macroeconomic data: Traders can monitor trends in GDP, unemployment, and retail sales for clues about the strength of a country’s economy. Strong data often coincides with rises in industrial commodity prices, while weak data can lead to lower prices.

Commodities End Markets

Intermediate-level fundamental traders may want to delve deeper into the end markets for commodities.

For example, strength or weakness in the commercial real estate markets in large cities offer clues about demand for steel and other industrial metals.

Similarly, the Cattle on Feed Report released by the USDA shows the future supply of cattle coming on to the market. This can offer clues about future beef prices.

After becoming familiar with interpreting the significance of these data points, traders can use them to make better trading decisions.

More Fundamental Analysis Strategies

As traders become more skilled, they can adopt more complex types of fundamental analysis.

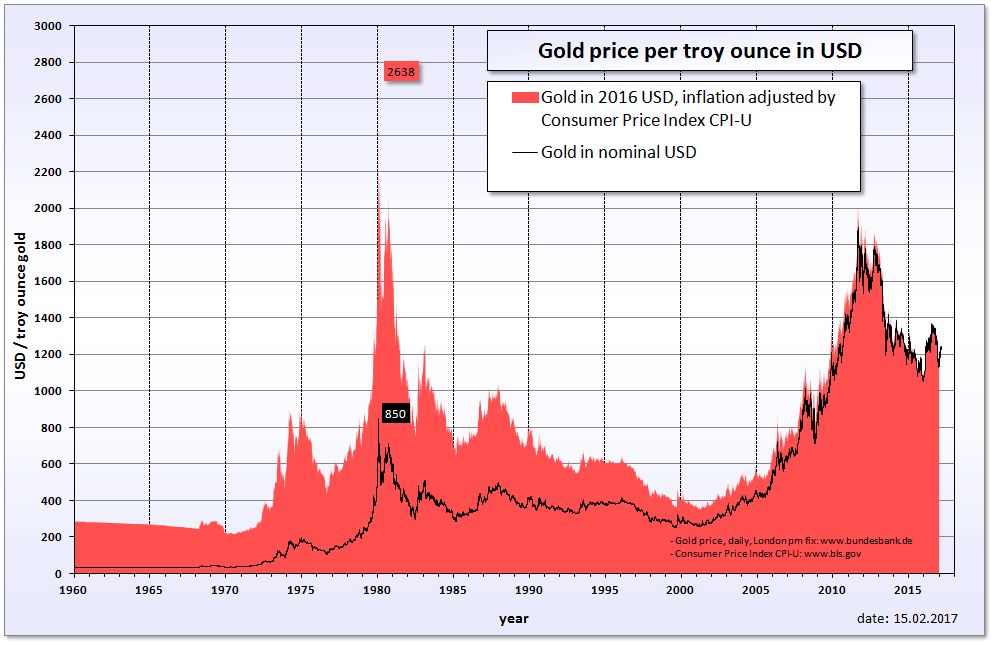

Bull and Bear Cycle Analysis: Identifying long-term secular trends in markets can produce the largest profits of any trading strategies.

Experienced traders look at the pricing of individual commodities compared to their long-term average prices. Differences in these two values often presage the beginning of long-term bull or bear markets.

A bear market is one in which prices are falling, encouraging selling, while a bull market is one in which prices are rising, encouraging buying. (Oxford Languages)

Broad Policy Assessment: Actions by central banks can presage movements in commodities prices. For example, a long period of easing by major central banks often leads to higher commodity prices, while a series of rate hikes can produce bear markets.

Major Commodity Analysis: The price action of commodities such as oil and gold often precedes movement in lesser commodities. For example, with an uptrend in oil prices a trader might check the prices of other fossil fuels such as natural gas and heating oil.

Production Output: Traders examine the output of leading producers for clues about big economic cycles. For example, companies might close mines and reduce output when metals prices are low. But these actions can also indicate that a market bottom is forming. Using production output from leading producers as a contrary indicator is another trading strategy.

Kondratiev Waves: This technique attempts to make long-term predictions of commodity prices based on economic cycles.

Technical Analysis

Technical analysis uses historical charts and data to analyze historical price trends which may have predictive value for prices in the future.

When doing technical analysis, traders look for price points in the past where significant buying or selling occurred to try and predict trigger positions once those price levels occur again.

Although some “purely” technical analysis traders pay no attention to fundamental factors in their trading, many traders use elements of both forms of analysis to make trading decisions.

Line Charts

A line chart shows the price of the commodity on the y-axis and the date on the x-axis. Traders should familiarize themselves with charting different time horizons such as hourly, daily, and weekly.

Each of these charts can provide information about entry points and the length of time to hold an asset.

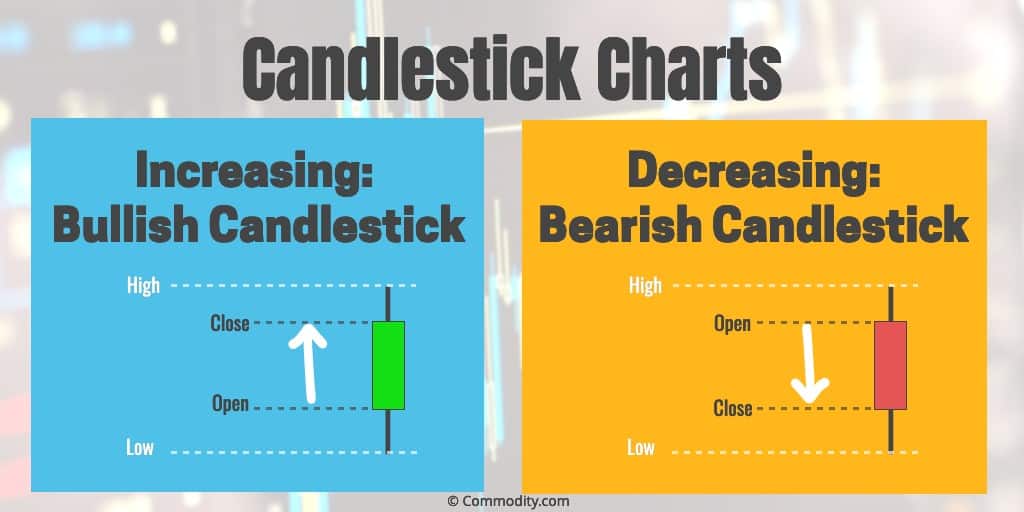

Candlestick Charts

Candlestick charts show the open, high, low and closing prices for each period being graphed. This data is in the form of bars known as candlesticks.

Technical analysis traders analyze the shape of candlesticks to predict future price directions.

Uptrends and Downtrends

Traders can use charting software to draw trend lines on charts and identify these patterns. Technical indicators can usually be added to broker charts with a mouse click.

- Uptrends: A series of higher highs and higher lows on charts indicates a bullish trading pattern.

- Downtrends: A series of lower highs and lower lowers on charts indicates a bearish trading pattern.

Comparing Different Assets

Another strategy technical traders might employ is comparing charts for different commodities. For example, crude oil and stocks historically enjoy a very high price correlation.

Moving Averages

This strategy takes the average closing price for a certain number of periods and then graphs this information as a line above the price chart.

When commodity prices trade through moving average levels, they can signal the direction of future prices.

Fibonacci Analysis

Fibonacci retracement analysis is based on the famous Fibonacci sequence of numbers. Ratios derived from this sequence are commonly found in natural objects as disparate as nautilus shells and pinecones.

Analyzing these ratios can be a way of trying to predict retracement levels for commodity price directions.

Retracement is a short-term reversal in the trend of a commodity’s price after which the price returns to its original trend.

- Fibonacci arcs are percentage arcs or circles based on the distance between major commodity pricing highs and price lows.

- Fibonacci fans use ratios based on time and price to construct trendlines and to measure the speed of a trend’s movement, higher or lower.

- Fibonacci time extensions can be used to identify the next high point or low point of a commodity price.

More Technical Analysis Strategies

Experienced traders also rely on more sophisticated technical analysis strategies like the following.

Breakouts: Traders chart resistance and support levels on charts based on historical levels. Breaches of resistance levels generally indicate a move to higher prices, while breaches of support levels often indicate lower prices.

Commodity Channel Index (CCI): This powerful technical indicator generates buy and sell signals for commodities based on how overbought or oversold they are. The indicator is designed to profit from changes in price trends.

Cash and Carry Arbitrage: With this strategy, a trader will take a long position on a commodity (betting the price will rise) while shorting (betting the price will drop) a futures contract for the same commodity.

This arbitrage strategy helps to mitigate risk if the futures contract is expensive compared to the commodity’s spot price. “Cash” refers to the long position while “Carry” refers to the futures contract.

Spread Trades: A spread trading strategy involves buying one commodity while at the same time selling a correlated commodity so that the net result is a profit for the trader even if they incorrectly guessed one leg of the trade.

Typically, spread trading is applied to futures or options contracts, which is called a time spread.

2. Mitigate Your Risk

Before you begin trading, you must face the fact that it can be a risky endeavor. Here are some ways you can reduce your exposure.

Position Sizing

Traders should research historical price ranges of commodities as a guide to calculate worst-case scenarios. Entering positions in small sizes can enable traders to make margin calls if markets move against them.

Risk Management

Sometimes the best-researched ideas simply don’t pan out the way we expect. Many novice traders hold on to losing positions and hope that they will return to profitability.

This focus on increasing profits rather than limiting losses is a major mistake that traders at all levels must learn to avoid.

This erroneous way of thinking that, “I’m overdue,” is sometimes called the gambler’s fallacy or the Monte Carlo fallacy. It’s the incorrect belief that a pattern of results will make a desired outcome more likely, despite statistical evidence to the contrary.

One way to avoid this problem is to place disciplined stops on commodity trades. A stop is a level below which a trader exits a long position. Using guaranteed stops on trades is may help to ensure that small losses don’t turn into big losses.

Diversification

A basket of commodities helps protect traders from the volatility of any individual commodity. It also adds diversification to a stock and bond portfolio.

Trading a basket of commodities can accomplish three goals:

- It can provide protection against inflation.

- It can add diversification to a portfolio that is heavily comprised of financial assets.

- It can protect a trader from the volatility of movements in individual commodities.

One way that traders can diversify their commodities portfolio is by trading different types of derivatives with exchange-traded funds (ETFs), index funds, or exchange-traded commodities (ETCs).

Related: Commodities through financial instruments like derivatives are classified as securities. We conducted a study on which US states are the most dependent on the securities industry.

3. Choose to Buy or Sell

As with stocks and bonds, speculators in commodities markets look to buy an asset at a low price and sell it at a higher price or vice versa.

Here are some points to consider about commodities trading versus stocks and bonds.

- Leverage: Futures markets offer traders increased leverage, which can produce both bigger gains and bigger losses.

- Volatility: Commodities can be more volatile in the short term than stocks and bonds. Many of the factors that impact supply and demand for commodities can be hard to predict — eg, weather, social unrest, labor strikes, crop failures, etc. When these factors change, any trading instrument can suffer abrupt price changes.

- Fundamentals: Stock and bond markets have fundamental data points that can sometimes drive prices. Price-to-earnings ratios, interest rates, credit ratings, and debt-to-equity ratios are some of the metrics traders use to price stocks and bonds. Commodities, on the other hand, have few such reliable metrics, if any. Commodities prices are usually driven by short-, intermediate- or long-term market sentiment. As a result, analyzing commodities markets is much more difficult.

Read about specific factors that can impact prices for commodities on our individual commodities pages like: gold, crude oil, or corn.

4. Make a Practice Trade

Many online brokers allow traders to create a demo account before making live trades. These practice accounts let you use play money on their live platforms to test your trading strategies.

Brokers Offering Demo or Practice Accounts

Here is a list of online brokers with demo accounts that offer traders based in the ability to speculate on commodity prices through futures, options, ETFs and other methods.

Loading table.CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Avoid Common Trading Mistakes

There’s no way to avoid it: every trader makes mistakes. But you can learn from the mistakes others have made. Here are some rookie mistakes to avoid.

☛ Use a live (real-time) pricing chart. Traders use pricing charts to make decisions about when to enter and exit trades. However, some “real-time” charts on the internet can lag 20 minutes or more behind actual real-time prices.

☛ Don’t confuse similar commodities. Do your homework so that you know the difference between feeder cattle and live cattle or Brent crude oil and WTI crude.

☛ Don’t confuse price types. When trading CFDs on a commodity – eg, gold – it’s important to understand whether the underlying asset you’re trading on is the spot price of gold or a gold futures contract. If it’s the latter, a trader must make note of which month the futures contract is based on because there’s a separate futures contract with a different price for each month.

IMPORTANT: CFDs are not available in the USA due to local regulation, and regulated brokers do not accept US citizens or US residents as clients.

Where to Trade Commodities

When you are ready to start trading commodities, you’ll need to pick a broker.

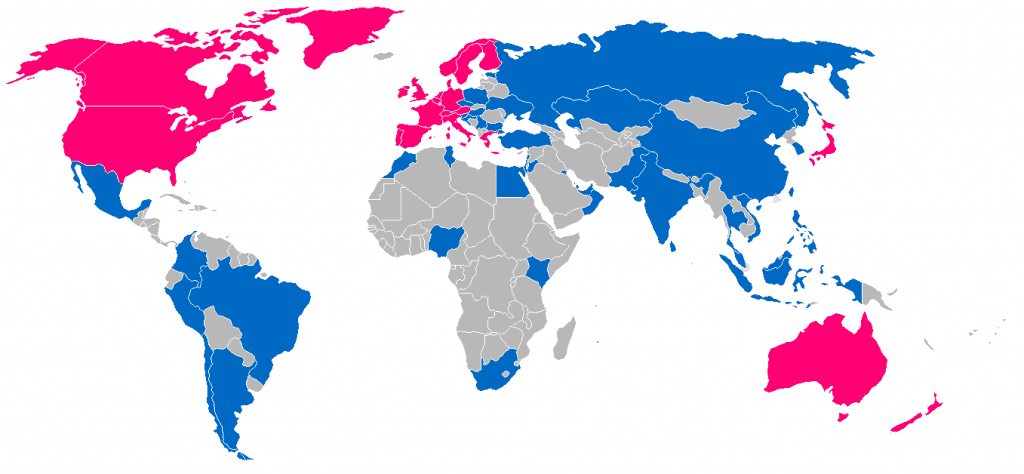

- You’ll need a broker that gives you access to the commodities exchange markets you’re interested in.

- Not all brokers are available in all countries.

- Be sure to check that the broker offers a demo account.

Here’s list of brokers that are available in that offer a variety of ways to speculate on commodities:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

If you need more help choosing a broker, check our overview of commodity brokers and then drill down to our detailed reviews of the ones on your short list.

FAQs

Here are some answers to common questions we receive about trading commodities.

What are commodities?

Commodities are the raw materials that drive the economy. They are generally divided into soft commodities (agricultural goods) and hard commodities (metals and energy). These are the goods that are used as inputs into the manufacture of other goods. For example, wheat is used in the manufacture of flour and breakfast cereal.

Crude oil is probably the most important commodity. It is used to create other commodities like RBOB gasoline and heating oil. But even crude oil itself can be subdivided into Brent Crude and West Texas Intermediate (WTI). Crude oil is usually priced in terms of Brent Crude.

For an introduction to commodities, check out our Commodity homepage primer.

Are commodities high risk?

Commodities trading can be risky. In addition to the normal volatility of markets, commodity prices are affected by various external forces like the weather and the value of the US dollar. Commodities are also typically traded using leverage, which means that you could lose substantially more than you initially speculate, like any other type of leveraged trading. Never trade more than you can afford to lose.

What is the Commodity Futures Trading Commission (CFTC)?

The CFTC is a US governmental agency that regulates futures, options, and other trading derivatives. It is tasked with protecting traders from market manipulation and other abuses. It came into being with the Commodity Futures Trading Commission Act of 1974, which replaced the Commodity Exchange Act of 1936.

What are forwards and futures contracts?

There are two kinds of contracts: forwards and standardized (or just “futures”). Both forwards and futures contracts bind the seller to deliver an agreed-upon amount of a commodity for an agreed-upon price at an agreed-upon date. In exchange for this obligation, the seller receives all or some payment upfront for the commodity.

The main differences between the two contracts types are as follows:

| Futures Contracts | Forwards Contracts |

|---|---|

| Require a margin | No margin required |

| Appeal to speculators | Appeal to hedgers |

| Trade on derivatives exchanges | Trade over-the-counter (OTC) |

| Amount of underlying assets are standardized | Amount of underlying assets can be customized |

What are the top global commodities exchanges?

| Exchange | Founded | Description | Interesting Fact |

|---|---|---|---|

| Chicago Mercantile Exchange (CME) | 1898 | This American financial and commodity derivatives exchange offers one of the largest menus of futures and options contracts of any exchange in the world. | Began as the Chicago Butter and Egg Board, a dairy exchange. |

| Chicago Board of Trade (CBOT) | 1848 | A subsidiary of the CME Group since 2007, the CBOT offers more than 50 different futures and options across several asset classes. | Oldest futures and option trading exchange in the world. |

| New York Mercantile Exchange (NYMEX) | 1882 | The world’s largest physical commodity exchange, the NYMEX was acquired by CME Group in 2008. | Operates Commodity Exchange, Inc., (COMEX), a leading metals exchange. |

| Intercontinental Exchange (ICE) | 2000 | US-based electronic exchange that focuses on global commodities futures markets and cleared OTC products. | Began as an exchange focused on energy markets. |

| London Metals Exchange (LME) | 1877 | UK-based exchange that offers futures and options trading primarily on base metals. | Although formally founded in 1877, the exchange traces its origins back to the reign of Queen Elizabeth I in 1571. |

| Australian Securities Exchange (ASX) | 1987 | Australia’s primary securities exchange, ASX offers futures and options markets on agricultural, energy and electricity commodities. | ASX merged with the Sydney Futures Exchange in 2006. |

| Tokyo Commodity Exchange (TOCOM) | 1984 | The largest futures exchange in Japan, TOCOM trades precious metals, energy and agricultural products including rubber. | Formed from merger of the Tokyo Textile Exchange, Tokyo Gold Exchange and Tokyo Rubber Exchange. |

How much do professional commodities traders make?

According to the Houston Chronicle, a trader with more than 5 years experience can make a quarter-million dollars per year — or more. And those working in the banking industry make substantially more than those working for trading firms.

According to Glassdoor, the average commodities trader makes $30,559 per year plus $101,862 in additional compensation. But this amount can change dramatically with industry and experience.

Credits: Original article written by Lawrence Pines. Major updates and additions in by Natalie Mootz and the Commodity.com editorial team.

Written byFrank has been a freelance writer for over 25 years — specializing in technology, business, and HR. He also blogs about music, politics, and horror films from his small apartment in the San Francisco Bay Area.